Wrapping Up an Incredible Year

- LVM Capital

- Dec 23, 2024

- 2 min read

Updated: Dec 24, 2024

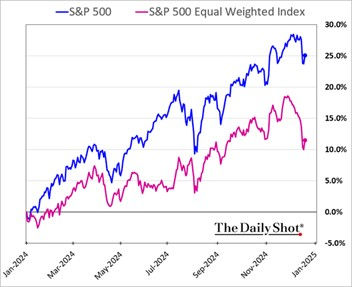

As of this writing, the S&P 500 stock index is up 24% year-to-date (excluding dividends). After the 23% gain in 2023, this marks the first time the index has risen by at least 20% in consecutive years since 1995 to 1998 during the internet boom. Big technology and communication stocks have accounted for the majority of the gains over this two-year period, while most other sectors have underperformed the index.

Sector Concentration and Performance Divergence

Technology and Communication Services now comprise 42.2% of the market-capitalization-weighted S&P 500 Index. On an equal-weighted basis, however, these two sectors account for a much smaller 18.2% of the index. This disparity highlights a stark performance differential between the market-cap-weighted and equal-weighted versions of the index this year.

Drivers of Market Gains

Stocks have risen over these two years due to rising revenues and earnings as well as increased valuations as interest rates and inflation have been reduced. Consumption has been strong as solid income growth has enabled consumers to increase spending while still maintaining decent savings rates. Unemployment has begun to rise, but it remains low relative to historical standards. In the past, when the Fed has cut rates and the U.S. did not enter a recession, U.S. equities rose 18% on average in the 12 months after the first Fed rate cut. U.S. growth and lower Fed rates have historically been a powerful combination for stocks.

Outlook for 2025

Consensus expectations call for further revenue and earnings growth among S&P 500 companies in 2025. Notably, earnings growth is broadening beyond the technology sector into non-tech areas, which could be further supported by potential deregulation and tax cuts. If these forecasts prove accurate, stock performance will largely hinge on valuation changes.

A recent survey of money managers identified trade wars and inflation as the greatest risks to earnings. Current valuations are elevated by several measures. The S&P 500 trades at a forward price-to-earnings (P/E) ratio of 22x compared to a 20-year average of 16x. However, the composition of the index has evolved significantly, with a higher weighting in faster-growing technology stocks and reduced exposure to slower-growth industries such as energy and materials. Corporate profit margins are at all-time highs, contributing to elevated valuations.

Valuation Considerations

U.S. stock valuations are also high relative to other countries, reflecting stronger economic growth and superior earnings growth. However, historically, higher valuations have tended to lead to lower returns over time as valuations normalize. As a result, we do not expect 2025 returns to match the robust gains of the past two years.

Investment Approach

As we evaluate companies for your portfolio, we remain focused on identifying those with strong earnings growth potential, attractive valuations, robust balance sheets, and healthy free cash flow. We believe such companies are well-positioned to deliver solid long-term performance.

Holiday Wishes

All of us at LVM extend our warmest wishes to you and your loved ones for a Merry Christmas, Happy Holidays, and a healthy, happy, and prosperous New Year!

Hozzászólások