A Tale of Two Cities

- LVM Capital

- Mar 5, 2024

- 3 min read

Updated: Mar 6, 2024

It was the best of times, it was the worst of times, it was the age of future rate cuts, it was the age of higher for longer, it was the epoch of soft landings, it was the epoch of hard landings, it was the earnings season of growth, it was the earnings season of lowered guidance, it was the bull market of hope, it was the bear market of despair.

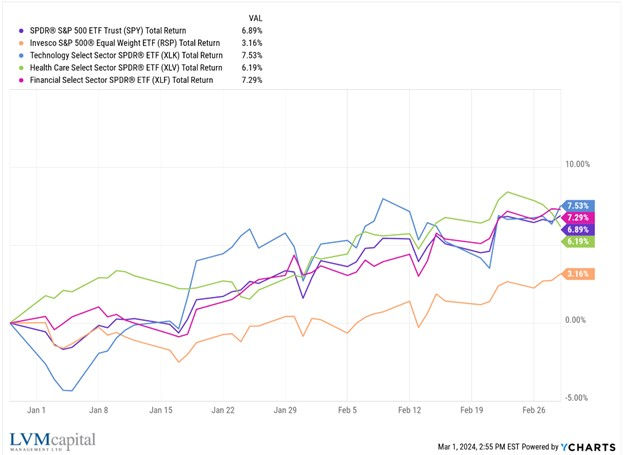

It certainly is a time of paradoxes in today’s market, as also laid out by Charles Dickens in his opening lines of the historical novel, A Tale of Two Cities. We will begin in reverse order of the enigmas laid out above, the bull market of hope and the bear market of despair. The S&P 500 has rallied 24% from the October 2023 lows just 125 days ago and has returned 7% during the first two months of the year. For now, it seems like a rally nobody believes in. We have seen some investor sentiment indicators turn positive, while consumer sentiment represented by the University of Michigan Survey is still well below the levels witnessed pre-pandemic. Over the past 14 months, we have also witnessed a stark outperformance of the “Magnificent 7” stocks driven by their strong current and expected earnings growth on the backs of AI growth and investment. While the equal-weight S&P 500 has kept pace over the past few months, in 2023 the average stock underperformed these large cap companies substantially. A broadening out of this rally might help boost confidence in the rally. Strong year-to-date performance in sectors like health care (+7.2%) and financials (+6.2%) could convince investors that the rally is not just in AI-related stocks.

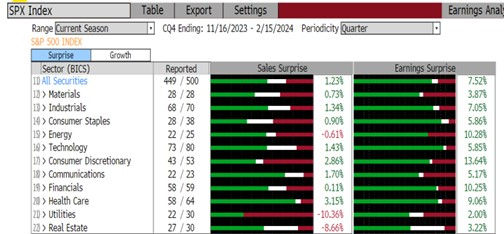

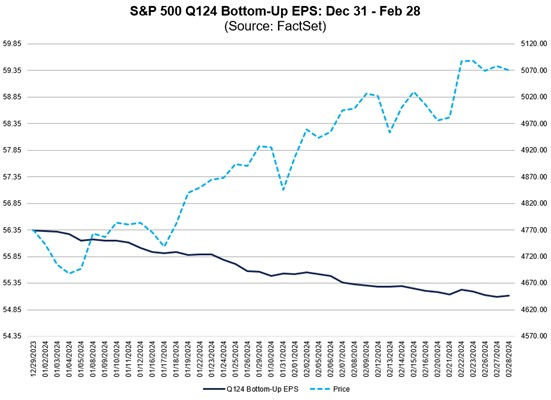

The earnings season of growth references the 4th quarter earnings reports that are nearing a conclusion. With 90% of the index reporting earnings, S&P 500 earnings grew 6.8%, which was 7.5% (top two charts) better than expected. The strong earnings reports have helped boost stock prices as most of the time in the market it’s not about good or bad, it’s about better or worse and the positive surprises in earnings were spread across every sector. The flip side is that earnings for the first quarter of 2024 have been revised lower by 2.2% (bottom chart).

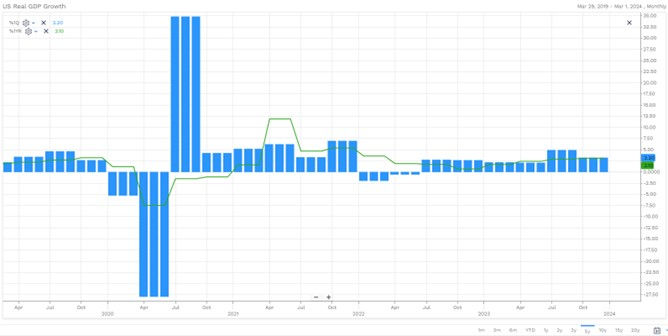

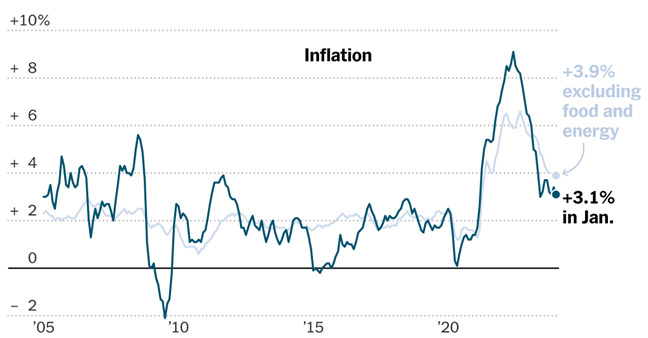

The epoch of soft landings can easily be supported by the faster than expected GDP growth. In January, we received the first estimate of 4th quarter 2023 economic growth which showed the economy expanded at a 3.3% pace compared to the 2% economists were projecting. This was recently revised to 3.2% but is still much better than expected (top chart). On the other hand, various inflation readings have come in hotter than expected which could table the conversation for lower federal funds rates and thus act as a deterrent to growth. The January CPI report published on February 13 showed a year-over-year increase in inflation of 3.1% (bottom chart) which was higher than the 2.9% expected by economists.

Finally, the original kindling to spark the rally in October stemmed from the expectation that the Federal Reserve would lower their benchmark interest rate. At the start of 2024, the market expected the Fed to cut rates in March; now expectations for the first cut are in June. The market was pricing in the Fed Funds rate to be between 3.75% and 4% at the end of 2024, but now it is expecting the rate to be closer to 4.75%.

There are always a bounty of reasons to be selling stocks and there may be interruptions to economic progress along the way, but at the end of the day, owning high-quality businesses that are innovating and sharing their financial success with their shareholders will win over the long-term as it has for the past 100+ years of market history. Let compound interest work in you and your family’s favor and follow the late Charlie Munger’s first rule of compounding - never interrupt it unnecessarily.

Comments